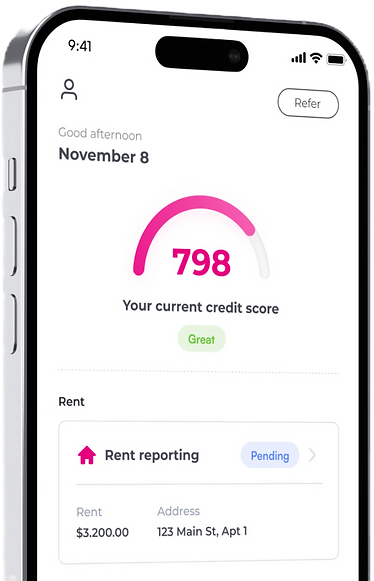

CAP se ha asociado con Boom para ayudarte a vivir tu mejor vida

Los inquilinos que utilizan Boom ven su puntuación crediticia aumentar en un promedio de 28 puntos en las primeras dos semanas*

*Los resultados no están garantizados y dependen de una variedad de diferentes factores, como el tiempo que ha sido residente, su puntaje de crédito actual, etc.

¡Sus pagos de alquiler a tiempo ahora pueden ayudarle a mejorar su puntaje de crédito!

Sabemos que el alquiler es probablemente su mayor gasto mensual y queremos recompensar sus pagos puntuales ayudándole a construir su crédito y aumentar su puntaje crediticio. Por eso, a partir del 2 de enero de 2025, todos los residentes de CAP se han inscrito automáticamente en un nuevo servicio de informes de alquiler "solo positivos" que les ayudará a construir fácilmente un futuro financiero más sólido. Este servicio tiene una pequeña cuota mensual de $5.95.

¿Qué debe hacer a continuación?

Preguntas frecuentes

¿Qué es el informe de alquiler?

El reporte de alquileres es el proceso mediante el cual se informan los pagos de alquiler a las agencias de crédito que generan los informes crediticios. La información de estos informes se utiliza para calcular su puntaje crediticio. Por lo tanto, el reporte de alquileres es una forma en que CAP recompensa sus pagos puntuales, ayudándole a aumentar su puntaje.

¿Cuál es el impacto que los inquilinos deben esperar en su puntaje de crédito?

La puntuación crediticia de cada persona es única y no podemos garantizar un aumento. Sin embargo, la mayoría de los inquilinos experimentaron un aumento promedio de 28 puntos en las primeras dos semanas. Para los inquilinos con una puntuación crediticia inferior a 550, el aumento promedio fue de 73 puntos en los primeros seis meses.

¿Cómo se traduce un aumento en la puntuación crediticia en el mundo real?

Si decide comprar un automóvil usado de $15,000 con un pago inicial de $2,000 en un plazo de préstamo de 5 años, un aumento de 80 puntos en su puntaje de crédito puede resultar en un ahorro de intereses de aproximadamente $3,000.

¿Hay algún costo por este servicio?

Sí. Se cobrará una tarifa de $5.95 mensuales y todos los inquilinos se inscribirán automáticamente en este servicio. Si desea cancelar su suscripción, haga clic en el botón al final de esta página y envíe su solicitud. Tiene hasta el 2 de enero de 2025 para cancelar su suscripción .

Si realizo un pago tardío, ¿perjudicará mi puntuación?

En general, no. Solo informaremos a las agencias de crédito sobre los pagos puntuales . Si no realiza un pago, Boom informará a las agencias como "sin datos", lo que no afecta su historial crediticio. Según Boom, la mayoría de los inquilinos verán un aumento de 28 puntos en su puntaje crediticio en las primeras dos semanas.

¿Qué se considera un pago tardío?

Al igual que otras obligaciones que monitorean las agencias de crédito, los pagos de renta se consideran atrasados 30 días después de la fecha de vencimiento. Si no realiza un pago, Boom informará a las agencias que no hay datos, lo cual no afecta su historial crediticio.

¿Cómo se verifica mi pago?

Los pagos de alquiler se verifican automáticamente cada mes a través de su cuenta en línea en el sistema de gestión de alquileres, con confirmación de CAP Real Estate.

¿Cómo puedo cancelar mi suscripción a este servicio?

Tiene hasta el 2 de enero para cancelar su suscripción a este servicio. Si desea cancelar su suscripción, haga clic en el botón de abajo y complete el formulario de la página siguiente para enviar su solicitud. También puede enviar un correo electrónico a hello@boompay.app.

Si desea darse de baja del nuevo servicio de informes de alquiler, haga clic aquí

*Revise su contrato de arrendamiento para ver si incluye el requisito de informe de alquiler.

Si su contrato de arrendamiento no requiere que usted esté inscrito en el informe de alquiler, puede optar por no recibir este servicio.

A partir del 2 de enero de 2025, la participación en este servicio será obligatoria para todos los residentes del CAP.

*Haga clic derecho en el botón de arriba y copie la dirección de correo electrónico adjunta. Podrá enviar un correo electrónico y cancelar la suscripción a los informes crediticios. *

.png)